We are back after the apocalyptic floods in Dubai, Token 2049 and the various events that surrounded it like Blockchain Life, Eth.Dubai and Artsdaofest. It was a crazy week that had several top tier events happening at the same time at various locations around the Dubai metropolis. Given the state of the roads (and information thereof!) it was not possible to do the usual bit of face time at an event and then move onto another one. If you went somewhere, you more or less stayed there. So there may be something to this metaverse idea after all!

The highlight of course was the rescheduled Delchain private dinner where yours truly was identified as “the Stig”. I’ll take it 😊! Several attendees regaled us with their off-road stories for journeys that should have taken minutes, taking hours and involving [redacted!] (let’s just say they had their hazard lights on!) and general stress testing of their Jeeps / SUVs. Now that’s client dedication for you! It was a credit to the Delchain team that so many made it. In addition it was nice to meet a few of the people from the Delchain team and whisper “Habibi, come to Dubai!” into their ears.

Watch this space!

What next?

We are having a little market correction / dip at the moment. This is healthy as it was getting pretty ridiculous these past few weeks with everything doing x1 / x2s and more. If you were waiting in the sidelines for an entry point, you either just had it or you are about to get it. We had an idea of talking about one of the hot topics of Token 2049, namely, Real World Assets but we have parked it to instead talk about something that broke last weekend, an entirely new concept called #MeFI.

Me What?

Going back to our first article back in January, we mentioned a project called $SOLID (https://twitter.com/SolidlyLabs) – this is the one that went from 0.24 to almost 4 USD over the Christmas break before retracing to 1 USD, and subsequently dropping below it. $SOLID is now available on $ETH, $FTM, $OP, $BASE and $ARB (why $Base is particularly important will be revealed shortly). They have been working away on a fundamental problem in the … sigh… Memecoin space, namely how do creators of memecoins earn fees without resorting to hidden wallets dumping their token or other damaging activities for the project? Enter #MeFI https://twitter.com/SolidlyLabs/status/1784297246151909842 – I recommend that you read the Medium article a few times, there are quite a few little nuggets in there that will reveal themselves on a re-read. The product, Memeboxfi (https://twitter.com/MemeboxFi) will have launched by the date of publication of this article.

The writer’s views on memecoins are well aired at this point, they are the purest form of gambling in crypto you will see. Some will be monsters for no good reason and the rest will go to zero and you will lose all of your money. The “thesis” for memes is the narrative and that changes with the wind so any success you may have might be short-lived and not repeatable. So if you must dabble in this space, do so with your “play” money, keep the house money in “proper” protocols.. ideally those not WIF hats! Caveat Emptor.

Me Buildoooor

If you are a Developer or if you know any, sent them the Tweet above and they will love you forever. There is of course a prize for the 1st 10 projects to succeed using their product https://twitter.com/SolidlyLabs/status/1785026504964911587 ($100,000k USD shared equally) the rules are simple:

1. Launch a fresh meme on @MemeboxFi

2. Reach a market cap of $1m AND cumulative volume of $5m (~50/50 ratio)

3. Organic! Foul play will be disqualified (artificial methods)

It will be interesting to see how this plays out.

Me Meme Dex

The main issue with the current Meme launching set up is how does the team fund the development of the token and continue to market it after launch. There are two principal methods used in the market, both are bad for the longevity of the project. 1. Team sells the native tokens (i.e. the memecoin itself) in their treasury on the market to fund operating costs and 2. A purchase and sales tax is imposed on all trades of say 5% to generate fees for the protocol in native tokens which, you guessed it, they dump on the market to fund operating costs and development costs.

What Memebox is doing for developers is solving that problem in a number of ways:

- Extension of the ERC-20 standard for liquidity (LP) tokens, called ERC-42069 – a double entendre if ever I saw one!

- Fee abstraction: Fees are now accounted for separately from the LP pool balances – i.e. you get paid fees partly (i.e. 50%) in the native blockchain token as opposed to your own meme token, you can sell the $ETH, $SOL or $FTM generated and not crash the price of your project.

- ERC-42069 specific zero transfer that burns LP tokens to an address and the user (developer) retains the ability to earn fees in perpetuity

- Co-pilot role for pool fees, this allows projects to manage (i.e. rent or sell) their own pool fees within programmatic boundaries an removes the need for complex tax-on-transfer tokens

There are more bells and whistles, please read the medium article for an in depth understanding https://medium.com/@seraph333/memecoin-infrastructure-2-0-f2b935fc6f8c

Me Money!

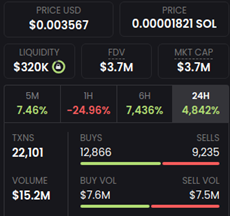

The devs at Solidly inserted a real time example into their medium article on how much money a developer could have made from the successful launch of their token – see extract below:

“A project on Solana has launched 8 hours ago with a total of $314k in liquidity and $15.2M in volume. Nearly all of the liquidity is locked, meaning that the creators earn close to zero fees.

If the project had launched on Memebox, the creators would’ve earned $91.2k in fees in just 8 hours, around 51% in $SOL and 49% in their project token. That is $46.51k in SOL, which could be used for buybacks, marketing and growing their community. It would also reassure investors as the team wouldn’t have a reason to have hidden wallets, dump on investors and fund themselves that way. This means that projects launching on Memebox will have a more favorable standing with the degen community at large, as incentives for insider dumping are significantly reduced.”

The above example assumes that the Developer had a 0.857% swap fee embedded in the contract. This swap fee is adjustable and replaces the buy and sell tax that is paid only in protocol tokens. We think this example will really appeal to developers on all chains as they are in it for the cash primarily.

Me Meme Yield

An additional string to the Memebox bow is to permit the developers to use the yield received from their locked or burned LP as collateral. This feature is not ready yet, it is undergoing audit. The process will look something like this:

- Developer launches Memecoin;

- Developer locks or burns their liquidity;

- Developer needs an upfront cash payment for their yield; and

- Developer can list their yield for auction, fixed price sale or rent

So this way a developer can tokenise their future income. The guys at Solidity will let the market decide if there are any takers for this very risky but potentially very lucrative asset and are providing the tooling for Memecoins. They will not restrict or police it, the market will decide what behaviour should be rewarded and what should be punished.

Me Meme Launcher

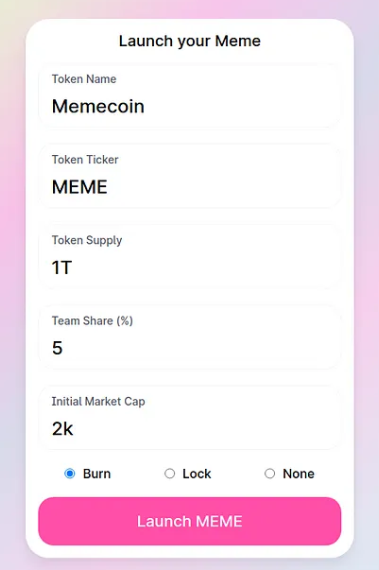

And now for the piece de resistance … a one stop shop token launcher. The emphasis is on memes as that’s the flavor of the day, but it can be used for any launch. For instance DAOs may find this to be a very interesting way to manage their treasury holdings.

The user fills out the field and clicks “launch meme”, what happens in the background is usually a long and tedious process lasting many hours, now distilled to a click of a button. Of particular interest, and with investors / gamblers in mind, is the classification of the token on the Meme Dex. A token launched with relatively little team shares and burned liquidity will be dubbed as “reasonably safe” (again, nothing is “safe” in cryptoland) whereas a token that launches with 90% team shares and no locked tokens will be considered dangerous. The team behind the latter token are creating it purely to dump on any unsuspecting investor / gambler. All of this data will be available on-chain and will also be listed on the Meme Launcher.

Me numbers!

All well and good, but what is in it for the developers of Memebox? Part of the fees of course! It is worth reproducing the relevant section in it’s entirety below:

“With Memebox, the traditionally known “fee switch” is activated from the start, meaning that 30% of all trading fees will go to to(sic) the protocol, while 70% remains with liquidity providers, which is a dramatic improvement over the 0% that liquidity providers are currently earning with other V2-style AMMs (because locked or burned liquidity earns nothing).

Of the 30% that go to the protocol (i.e. Memebox):

25% go to our new $SOLID staking contract (yield token: $SOLID)

25% go to max-locked veSOLID positions (yield token: $SOLID)

50% go to the Solidly Labs treasury until a treasury of $5m is reached

After our treasury has been bolstered, which will be used for expanding our team, development, marketing, listings, legal expenses and brand-building, the ratio will switch to:

40% $SOLID staking (yield token: $SOLID)

40% veSOLID (yield token: $SOLID)

20% Treasury (yield token: $SOLID)

In addition to swap fees, locking & burning (with ability to continue earning fees) incurs a 1% lock fee, which will be distributed at the same ratio as the swap fees.

Memebox will launch on all EVM-compatible chains (and Solana), irrespective of our SolidSync omnichain deployments via our V3 product suite. This allows us to be able to provide this essential public good to every corner of DeFi as quickly as possible.”

So while $SOLID is available on $ETH, $Base, $OP, $ARB and $FTM, this product will be available on all EVM compatible chains and Solana which is a huge advantage. There is no Meme Dex in the market, there potentially is one now (assuming the first launches are successful of course!). In addition, if it is wildly successful there will surely be copycats – however, this product has been in the works for a considerable amount of time (and audited twice!) so you may assume some lead time here, one unicorn in the coming weeks should do wonders for the $SOLID token price. $Base and $SOL have pumped quite a bit in value due primarily to the explosive growth of Memecoins being launched on these two chains, if a Meme Dex manages to establish itself it can take a piece of all the Memecoin pies.

Another little tidbit, the amount of locked $Solid ($Vesolid) is 74,856,770 https://etherscan.io/token/0x777172d858dc1599914a1c4c6c9fc48c99a60990?a=0x77730ed992D286c53F3A0838232c3957dAeaaF73 or some 89% of the total $SOLID supply. So the fee split between $Solid and $VeSOLID is in reality significantly skewed towards staked $SOLID holders, for every $1 USD a $VeSOLID holder will earn in fees a staked $SOLID holder will earn $9 USD, all for single sided staking with no risk of impermanent loss. I can only assume that anyone with liquid $SOLID would stake it the very moment the staking contract comes live.

I will leave you with this:

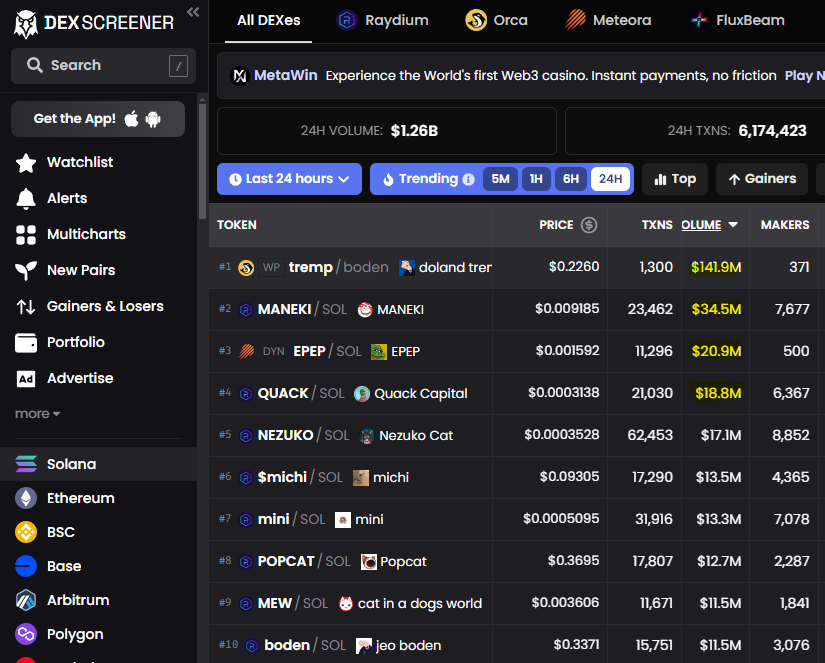

https://dexscreener.com/solana

Noting that at time of writing markets are dumping, the 24 hour volume on Solana (the current home of Memecoinmania) is $1.26 Billion, for the top 4 tokens by volume it is $141.9 M, $34.5 M, $20.9M and $18.8 M respectively. Taking No. 3, assuming this $EPEP token was launched on Memebox, $20.9M volume would leave fees of approx $182,875 (assuming a 0.875% swap fee in the contract) to be shared 30% with Memebox and 70% with the protocol LP providers.

LP providers: $128,012 USD (70%)

Memebox: $54,862.5 USD (30%)

Split as follows:

- Liquid $SOLID (staked): (25%) $13,716 (yield paid in $SOLID)

- Max locked (4 years) VeSOLID: (25%) $13,716 (yield paid in $SOLID)

- Solidlylabs treasury (until 5 MIO in the treasury) (50%) $27,431

That is $27,431 USD in buying pressure on $SOLID from one token launched on one chain in one day. If they get it right, it could well be a significant catalyst for sustained upwards price move. So more moon?? Perhaps, perhaps, perhaps.