The $ETH ETF was approved last week (for me anyway). You may copy paste the hype for the $BTC ETF when it launched though I suspect it will not be as strong. It will have a positive impact and number should indeed go up. How much is anyone’s guess. $ETH pumped almost 20% in a day on the expectation of an imminent announcement of an ETF approval, so part of the hype is priced in, but the proof of the pudding will be in the eating. Will institutional investors flock to an ETF that has more potential upside (and downside) vis a vis the $BTC ETF? If I was forced to choose one or the other, I would go with $ETH as it’s potential has not even started to be realised yet. As I mentioned in my very first article, it has its draw backs and is not perfect, but it does have enormous potential https://x.com/vaneck_us/status/1793755768837251281?s=46&t=jT8_THplhrtU4ASw-A6eSw

But I digress, I have wanted to write an article on Real Yield for some time. With the IntentX IDO happening at time of writing (https://x.com/IntentX_/status/1793775439363879055), I think now is as good a time as any.

Real Yield

So what exactly is real yield? It is rewards based on the performance of the protocol you are staking on. Put simply, income generated by token X is shared with the holders of token X. The rate cannot be guaranteed and is based only on the actual performance of the token / protocol. Hence the yield is “real” and not some made up emissions schedule that dilutes the value of the underlying token – like pretty much every liquidity farm in 2021.

Origin of the species

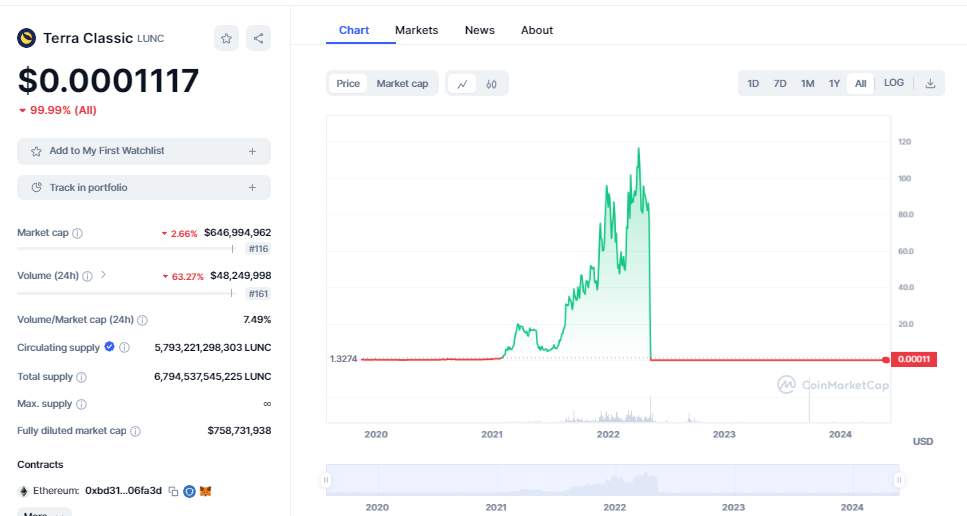

When you do not know the source of the rewards being used to pay you to stake on some Defi platform. YOU ARE THE YIELD! This is what anyone holding the algorithmic stable coin TerraUSD ($UST) found out in the great Terra – Luna crash of April / May 2022. You staked your $UST and got 20% yield by magic until … eh the algo holding it all together fell apart (i.e. 1 $Luna equals 1 USD worth of $UST). There was no real activity of $UST to support the 20% yield for any sustained period of time. Eventually the holders of $UST lost everything in the nuclear meltdown of $Luna. They ended up, unfortunately, being the yield.

You can read this article about it, https://www.sciencedirect.com/science/article/abs/pii/S1544612322007668 or just look at the Terra Classic chart to see a real live example of protocol risk.

EVERYTHING in crypto is exposed to protocol risk. It recedes over time as the network / protocol strengthens and the code is battle tested and new additions are audited. But that risk is never zero. Consider this and act accordingly. Before its death spiral, $LUNA was the top 8th token my Market Cap. A position now enjoyed by $DOGE… the original Memecoin… or is that $BTC?? (Discuss amongst yourselves)!

So this was, understandably, an earthquake for cryptoland and it toppled a number of entities in the Defi space that either held large positions of $LUNA / $UST or were owed money by the company behind $Luna or indeed pretty much every other algorithmic stablecoin on the market. $DEI …. My poor $DEI. Lesson here is even good and solid projects get hit when a sector collapses. It was the contagion effect in action. $DEI ultimately repegged, more part of the $DEUS ecosystem below.

Real world

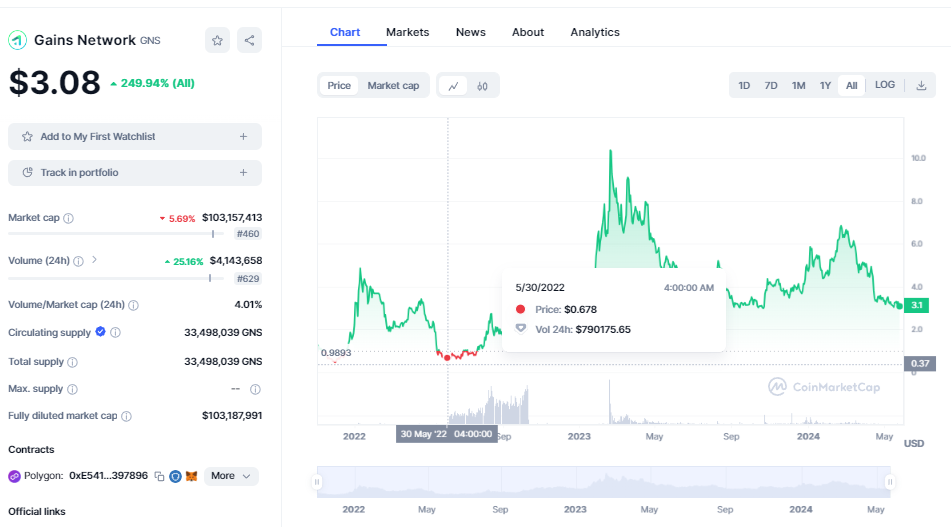

There were however a few protocols that had a protocol that rewarded holders with the revenue actually generated by it. I will focus on two and drop their charts here. You can see that both were battered in May / June of 2022, recovered strongly and have now fallen out of favour with the latest craze taking over (primarily Memecoin silliness). These were my bear market bets. They are at depressed prices now and there will be another bear market. Both are Perpetual DEX protocols. In a bull or bear market they will make money (primarily from fees to open / close trades, margin costs and the spread on your trade). Good leverage traders are not concerned with the direction of the market, so long as there is volatility they can trade.

In SEB we trust

First up, a project dear to my heart (my trade of 2022) is Gains Network $GNS. $GNS is a labour of love that started initially from one man, savant developer called Seb (he does not want to dox himself) who started this whole project off as Gfarm2 back in 2021. Gfarm 2 did a 1/1000 split to $GNS in 2022. Needless to say, if I could go back in time to 2021 I would tell myself… “Do not sell your Gfarm2!” amongst other things, but you cannot hindsight trade or you will go mad.

Seb grew the team and employed front-end and back-end developers to assist him in making the UI better and adding more functions to the platform https://gains.trade/trading#BTC-USD (go have a look) and the project has marketing and socials mods. Seb also pops into the Telegram chat daily /GMS is Good Morning Seb for those wondering! The platform is available on the $MATIC and $ARB chains. What makes this Dex very interesting is that it pioneered synthetic trades. There is no order book, you do not need to own the underlying asset to trade. You simply use your $DAI (a collateralised stablecoin) to open an order to long / short whatever asset you want with whatever leverage is available on that particular pair. Your trade is limited to the available open interest and your potential gain is capped at 900%, hit that level and it will automatically be closed and you will be happy!

Gains.trade offers crypto, forex and commodity trading. The Forex and Commodity trading is limited to the opening hours of the various physical exchanges around the world. No KYC required. Crypto is of course available 24/7. As everything is synthetic, they can add new pairs pretty quickly. The only consideration is the risk management of the pair, how much open interest will be permitted and what is the max leverage that will be permitted? The $LUNA shorts in May 2022 almost killed the protocol. Seb replenished the liquidity pool by selling 1 MIO USD worth of his own $GNS and opened delta neutral positions. (What a guy!) Unlike most CEXs, the Short positions were honoured, all longs were of course liquidated.

Another useful feature of gains.trade (of which there are many) is the scamwick protection afforded to users. The price feed shown on the interface is based on the feed provided by 6 CEXs. If one of the CEXs is materially different from the others, it is discounted and a consensus price is taken from the remaining 5 CEXs. Scamwicks happen by [ redacted!] – for example: Assume a dump on the value of $BTC on 5 exchanges from 60k to 55k but on one (let’s call it CCEX) it drops from 60k to 50k before immediately (in a second / minute or two) rising back to 55k to be in line with its peers. The CCEX longs get battered / liquidated and the CCEX shorts win (if they have limit sells set up). This issue is pervasive in CEXs and the reason whey the writer ceased leverage trading on CEXs before giving it up entirely.

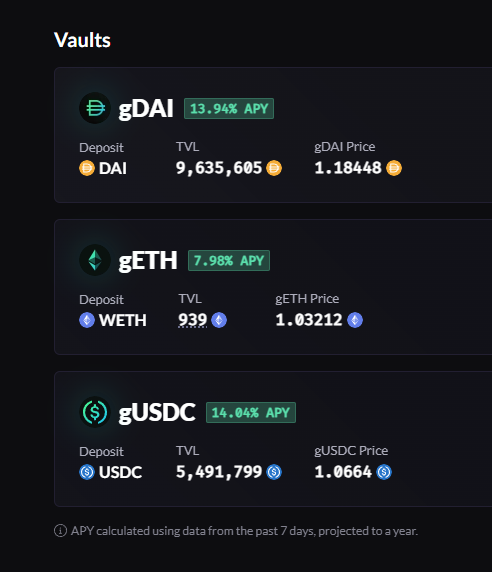

Suffice to say that gains.trade has a great product and generates lots of fees. https://x.com/GainsNetwork_io/status/1791589550591983720 ($191,774 in the past week). 62% of these fees go to stakers of $GNS on the protocol https://gains.trade/staking. You may also stake $DAI, $ETH or $USDC in the vaults (https://gains.trade/vaults) to receive a dynamic APR depending on the revenue actually generated by the protocol in the preceding 7 days. This is real yield.

By staking $GNS you are taking price risk of $GNS and protocol risk (there have been over 20 audits of $GNS at this stage so the risk is low). If you stake $DAI or $USDC you take $GNS, $DAI or $USDC protocol risk (again, extremely low for $USDC and $DAI).

The competition

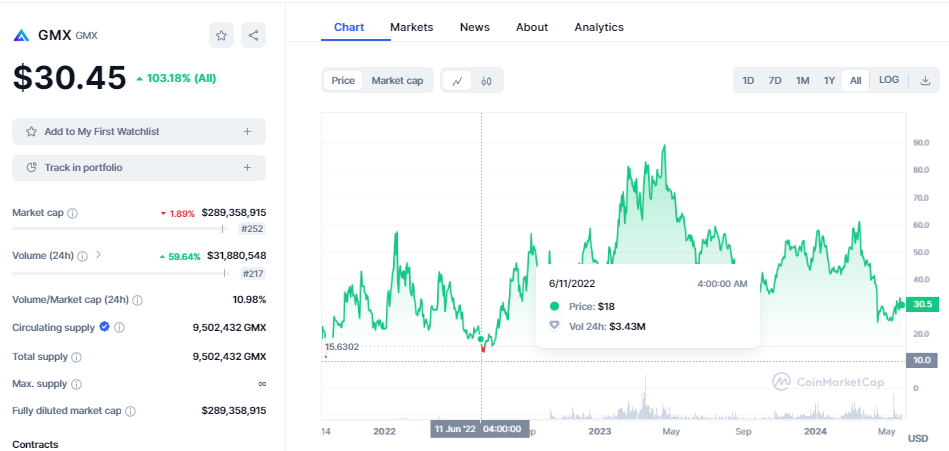

Next is its closest iteration (but higher market cap), $GMX. $GMX is similar to $GNS and, in the writer’s view, stole a march on $GNS by deploying to $ARB first and managing to capture a large number of DEX whale traders. Like every other walk of life, first mover advantage is a key factor to success in cryptoland. But lord help you if you go first and are buggy / have an exploit, it is a long way back from there.

Similar to $GNS it took a dive in June 2022, recovered, pumped and then retraced. It is available on $ARB and $AVAX.

Fees are here https://app.gmx.io/#/dashboard ($796k USD since 22nd of May 2024 at time of writing (24th of May 2024) so an order of magnitude more than $GNS fees.

APRs are here: https://app.gmx.io/#/earn what $GMX has done differently to $GNS is create a liquidity pool (GLP) and it provides bonus multipliers for those who stake their GLP. The issue is a large number of the whales I mentioned earlier staked their GLP and are continuously benefitting from it as there is no limit to this multiplier. This adversely impacts new entrants.

Backed

$BACKED is on $BLAST, $BASE and $MNT (the same chains as IntentX below). No token exists yet (TGE is on the way). You may deposit here https://app.backed.ventures/deposit if you are whitelisted and are fast enough to get your funds in before the cap is reached. Yield is currently 52% on stablecoins ($USDC) https://x.com/BackedVaults/status/1778541116289409281. Which is, to my knowledge, unheard of. Rewards are airdropped directly to your wallet periodically. $BACKED is an integral part of the $DEUS (https://x.com/DeusDao) and $SYMM (https://x.com/symm_io) ecosystem. It is the brain child of another savant dev Lafayette Tabor (https://x.com/lafachief). $BACKED is an on-chain equity vault technology that provides capital for protocols and generates real yield for depositors. The main user is $SYMM which has partnered with $INTX to provide it with solvers for their platform (i.e. the open interest to trade).

If you want to know more, have a read here https://docs.backed.ventures/ be active on their Discord and get your wallet whitelisted to add some funds whenever the caps are raised on any available chain. It is always filled fast! There are perks for the TGE if you are an early investor too (see the document).

The new entrant

As I mentioned earlier, IntentX ($INTX) is in the middle of its IDO at a $50 MIO valuation with 100% unlocked on TGE (expected to be 29th of May). The platform is here: https://app.intentx.io/trade/ETHUSDT and is available on $BASE, $BLAST and $MNT ($MNT is a token created and supported by Bybit). I wonder which CEX they will list on?? 😊

Intent

What is most interesting about IntentX is that it is intent based. The user proposes a trade and then a solver on the other side of the trade (using $MUON nodes – more on this in a couple of months!) will either quote for the trade or reject it. Like $GNS and $GMX, there is no order book. There are two solvers active on IntentX now with more in the onboarding stage. Why does this matter? Well, my dear reader, the solver can be a financial institution and therefore the permissible open interest is essentially limited only to their credit lines. This blows open DEXs as the risk management of the trade will not rest on the DEX (like $GMX and $GNS) and open interest be limited to their pool of capital. It is up to the solver to manage their risk on the other side of the trade. They should be delta neutral and living off the spread in the trade. Accordingly, IntentX can be one of the very big boys in the space. The writer might have mentioned that he was points farming this in the “airdrop” article. It is almost time to reap that reward.

Yield please!

For real yield however, it is extremely interesting as stakers of the IntentX token (staked $INTX referred to as $xINTX) will receive 85% of the fees generated by the protocol (with boosted rewards based on staking duration up to a max of 2.5 times) plus 10% of the revenue generated by the “front end as a service” offering they have Thena (https://thena.fi/), Befi (https://befilabs.com/) and Core Markets (https://www.core.markets/) are users already with more in the pipeline including Fenix (https://www.fenixfinance.io) and Based Markets (https://www.based.markets). Additionally, to receive the fees you must stake your IntentX giving you $xINTX. You will be subject to a 25% tax depreciating linearly over 16 weeks to a final exit fee of 1% if you remove your $xINTX at any time during that period. The 1% exit fee carries on in perpetuity. The penalty $xINTX are distributed rateably to other stakers in the pool. So by leaving your stack of $xINTX in the pool your $xINTX pile will grow as other people remove their tokens. This is particularly interesting considering that the TGE has a 100% unlock and all participants will receive $xINTX. Some will surely dump it on TGE. To ameliorate this, the team will pay out the backlog of the fees generated over a period of months (equal to several hundred thousand dollars) to stakers.

The stated objective of IntentX is to bring the DEX experience to a place that is superior to a CEX, considering all that they have done in the past few months, I do not doubt that they will give it a very good try indeed. Holders of $xINTX should profit handsomely from their endeavours. Roadmap available here https://medium.com/@IntentX/intentx-2024-roadmap-building-the-ultimate-perpetuals-dex-c54ebba9485f

Conclusion

Bull or bear you should have some exposure to a real yield platform. The above are some available in the market. They do not have their own category on Coinmarket Cap, the most interesting ones are in the Derivatives section https://coinmarketcap.com/view/derivatives/. They are not, unless you are very early, going to shoot the lights out with a capital appreciation, but you should get some nice recurring revenue based on the performance of the protocol. You, dear reader, will not be the yield.