We at Delchain hope you had an excellent start to the year. With a New Year we are trying out some new ideas. We will do some general education on what is crypto and bring you more esoteric ideas in cryptoland.

The starting point: Blockchain

Per Investopedia: “A blockchain is a digitally distributed, decentralized, public ledger that exists across a network”. So what does that mean? It is information (the ledger) like your financial statements that is in digital form and is available to anyone on a specific network. Blockchains can be public or private. Why does this matter? Because information on the blockchain is immutable and cannot be altered. Each package of information (usually a number of transactions) is added to a string containing all previous transactions on the blockchain, confirming the veracity of everything that went before and the new transactions being added. Hence the title “block” and “chain”.

How can a blockchain help my business? There are a number of ways, most common ones are:

- No need for reconciliations – all transactions are there available for all to see, every department is working with the same set of data. No “alternative facts”

- Data integrity – data on the blockchain cannot be altered

- Data security – access to the blockchain (if private) can be strictly controlled

Next step: Cryptocurrencies

Again, per Investopedia:

“A cryptocurrency is a digital or virtual currency secured by cryptography, which makes it nearly impossible to counterfeit or double-spend. Most cryptocurrencies exist on decentralized networks using blockchain technology—a distributed ledger enforced by a disparate network of computers.”

In short, crypto = virtual assets secured by blockchain technology.

What is the intrinsic value of a crypto currency?

That is the $64,000 question. The usual market forces determine the value of anything, supply and demand. Supplies of some crypto tokens are limited (e.g. for Bitcoin, there will only ever be 21 million of them). Factors that lead demand include, but are not limited to, the following:

- New technology – e.g. Ethereum bringing smart contracts to crypto;

- Narrative – e.g. Decentralised Financing / Gaming;

- Team behind the project;

- Backers of the project (e.g. Sequoia or Anderson Horowitz);

- Tokenomics of the project (i.e. there are not a bunch of VCs sitting on the sidelines with big bags ready to dump on you); and, rarely;

- Revenue share of the protocol (see https://gains.trade/staking)

There almost always is no traditional asset underpinning the value of any crypto, that is why the market is extremely volatile.

Categories of Crypto:

It can be pretty daunting to look at all of the 10,000s of cryptos out there and try to discern what token is undervalued and what is overvalued. As a rule of thumb for someone entering into the space, don’t buy anything outside the top 20 by Market Capitalisation, you still might lose your money, but if you start picking tokens randomly you certainly will lose your money.

Wallet security

The quickest way to lose money in crypto is to have your wallet exploited / hacked / drained. I.e. you click on something you should not have / confirm the wrong transaction and hey presto your assets are stolen by some nefarious character. There are a number of ways to mitigate this risk, the writer’s preferred one is simple wallet security.

You will need at least four wallets:

- Main trading / staking wallet – you connect this wallet to various websites (Decentralased Apps – (DApps)) to confirm transactions. This wallet contains minimal assets required for whatever transaction you have in mind. It is zero’d regularly.

- Mint wallet – you connect this to any site you are minting a Non Fungible Token (NFT) from. This wallet contains only the gas required for the transaction.

- Cold wallet – this contains the vast bulk of your assets, you never connect this wallet to any DApps or websites… ever. If you want to sell something in your cold wallet, you move it to the trading wallet and sell it there.

- Gaming wallet – crypto games will require that you enable huge numbers of transactions in order to play them seamlessly, so this wallet should have no assets on it at all.

- Project Wallets – you may have NFTs / tokens you want to stake in a separate wallet if they are valuable.

Never click on anything that appears in your wallet if you do not specifically remember buying it. These are usually trojan horses there to steal your assets. Anyone who Direct Messages (DMs) you first in Discord or Telegram after you ask a question of a team is a scammer, they are usually very good at cloning profiles so only ever have chats in the main chat, any side chat… you are talking to a scammer.

Ready Layer 1

We will do a quick overview of the Layer 1’s in crypto for you and then get further into other categories in the following weeks. Layer 1s are the foundation level of a blockchain. They are the main chain of the network, where blocks are added and transactions are finalized. The most notable layer 1s are as follows:

- Bitcoin: Where it all began. The original crypto currency created by Satoshi Nakamoto in January 2009.

- Ethereum: Ethereum is a global, open-source platform for decentralized applications. In other words, the vision is to create a world computer that anyone can build applications in a decentralized manner; while all states and data are distributed and publicly accessible. Ethereum supports smart contracts in which developers can write code in order to program digital value. A common example of a DApp built on Ethereum is an NFT.

The key technology here is enabling smart contracts. These allow 2 parties to transfer value between each other based on conditions and they do not need a 3rd party intermediary to facilitate the transaction. Smart contracts work on the “if this, then that” principle.

Main issue with Ethereum is it’s high Gas (transaction costs) and inability to scale.

- BNB: Binance Coin (BNB) is an exchange-based token created and issued by the Binance cryptocurrency exchange. In February 2019 it became the native coin of the Binance Chain.

- Solana; Solana offers users fast speeds and affordable costs. It supports smart contracts and facilitates the creation of decentralized applications (dApps). Projects built on Solana include a variety of DeFi platforms as well as NFT marketplaces, where users can buy Solana-based NFT projects. Its high performance means Solana doesn’t require a traditional scaling Layer 2 solution; instead, Layer 2s on Solana focus on interoperability and connecting Solana to other chains. It breaks every now and again!

- Cardano: Cardano is a Proof-of-Stake blockchain network that supports decentralized applications (dApps) with a multi-asset ledger and smart contracts. It has been some years under development and still is not ready. It has an enormous runway, so it will get there… eventually.

- Avalanche: Avalanche is a high throughput smart contract blockchain platform. Validators secure the network through a proof-of-stake consensus protocol. Avalanche is the fastest smart contracts platform in the blockchain industry, as measured by time-to-finality, and has the most validators securing its activity of any proof-of-stake protocol. This chain is where many suspect crypto gaming will find a home.

- Tron: Tron is a smart contract platform that offers high throughput, high scalability, and high availability for all DApps in the TRON ecosystem.

- Polkadot: Polkadot is a platform that allows diverse blockchains to transfer messages, including value, in a trust-free fashion; sharing their unique features while pooling their security. In brief, Polkadot is a scalable heterogeneous multi-chain technology.

Polkadot is heterogeneous because it is entirely flexible and makes no assumption about the nature or structure of the chains in the network. Even non-blockchain systems or data structures can become parachains if they fulfill a set of criteria. The founder does not really believe in marketing though.

- Ton: Toncoin is TON’s native cryptocurrency. It is used for network operations, transactions, games or collectibles built on TON which is a decentralized platform, created by the community using a technology designed by Telegram.

- Cosmos: The main idea of Cosmos is to allow for faster and cheaper decentralized applications — anything from an NFT marketplaces to decentralized exchanges — by allowing them to run on their own dedicated blockchains.

All of these independent blockchains (called “zones”) are interconnected by the Inter-Blockchain Communication protocol, or IBC. Cosmos also provides developers with prebuilt modules that allow them to quickly create blockchains that are completely customizable for their specific use case.

Should I buy all of these?

No!

Deeper into the weeds:

Considering the Jupiter airdrop that happened on the 31st of January we had thought of talking about Solana airdrop farming. Remember, this was the first of 4 annual airdrops. However, one project had a truly exceptional start to the year and it’s first three letters are SOL so it was written in the stars. We are of course talking about Solidly, which went from 0.226 USD on the 20th of December to 3.92 USD on the 3rd of January – a ridiculous move for such a long-term project (on the block in various iterations since 2022). You can see such pumps on a listing of a highly anticipated project, but rarely ever for an existing project. It has retreated to around 1 USD now so this is why you always take profits:

Reference: https://dexscreener.com/ethereum/0x53cce50d77f4e18c8bb633dd1c2fbe99e0fb71be

So, what happened?

What is Solidly? Solidly aims to become the most capital-efficient decentralized exchange in the Decentralized Finance (DeFi) landscape. It achieves this by improving upon existing Automated Market Maker (AMM) primitives and rounding everything off with a (3,3)-inspired incentive layer: It is the only v3,3 token used for Bridge project + PERP and DEX on 10 incoming chains. ONE unique $SOLID token. All values accrued to the same token. Sounds too good to be true. $LINK CCIP whitelisting + LIDO partnership + $SYMM partnership. #Solidly TOP #2 DEX on $ETH and $FTM. https://docs.solidly.com/introduction/welcome-to-solidly for a deeper dive:

In English please!

Solidly is a very efficient AMM. Usually, 50% cheaper gas fees using Solidly to swap and as they are so efficient with swapping, providing liquidity to the platform can bring you outsized returns. To the point if your strategy is liquidity provision you are almost negligent not having any allocation on the Solidly Platform https://solidly.com/liquidity. The platform also has Just In Time (JIT) Liquidity protection for its Liquidity Providers (LPs) to prevent vamp attacks on what should be your fees for swaps on pairs you are providing liquidity for – other DEX’s like ahem… Uniswap do not have this feature so their real APRs are different. JIT bots are always stealing your lunch, the APRs quoted are not accurate as they do not take into account vampire JIT attacks on your fees. On Solidly LP’s start earning immediately after minting but they have a 10 minute “ramp-up” time. When a swap happens, the fee is distributed pro-rata among all liquiditySeconds of the past 10 minutes. A position that is minted and burned in the same block accrues zero liquiditySeconds meaning that 1-block JITs would donate their fees to the providers of the previous 10 minutes. What JITs do is they see the order coming in, then send heaps of liquidity to the pair, the trader gets the best price but the longstanding LP providers make a fraction of the fees they would otherwise have made.

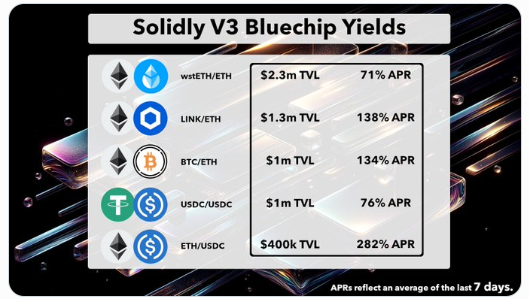

Here are some APRs posted by the team on the 30th of December that are based on the average rate over the preceding 7 days (i.e. what was paid out!):

There are a range of options for providing liquidity so take these with a pinch of salt, but they are orders of magnitude better than other Dex’s or Cex’s. This is the flywheel effect, efficiency in transactions, leads to more efficient use of Total Value Locked (TVL) (i.e. the liquidity providers). These rates will decrease as the TVL increases on the platform of course, but the underlying efficiency remains. That is the key point.

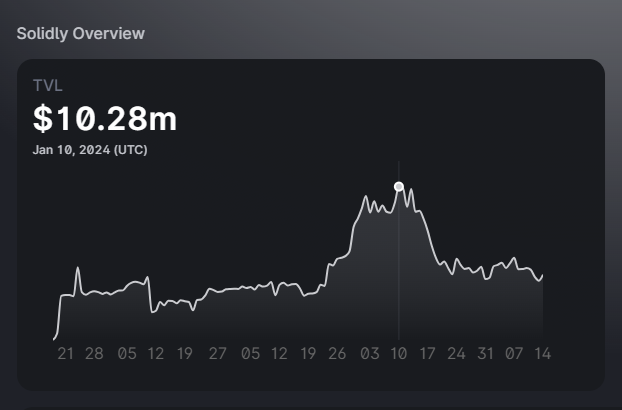

You can see the spike in price is directly correlated to the TVL spike from $3.2 MIO USD on the 21st of December to an All Time High (ATH) of $10.28 MIO in early January https://analytics.solidly.com/#/ before falling off to $4.5 MIO on Ethereum by mid February. However, it now has $1.68 MIO on FTM, $1.1 MIO on Arbitrum, $1.39 on Optimism and $500k on Base so overall the TVL now across 5 chains is the same as it’s All Time High (ATH).

But wait there is more!

Apart from liquid $SOLID there is also VeSOLID – an NFT (ERC-721 i.e. splitable) comprising of locked $Solid (up to 4 years) that provides the holder with the following benefits:

- Earning: veSOLID earns 20% of the trading fees that the Solidly protocol generates, furthermore veSOLID earns 100% of the bribes that are made by various protocols looking to bootstrap liquidity on the Solidly platform.

- Voting: veSOLID holders can vote which pools to incentivize each week with SOLID emissions on a pro-rata basis and receive instantly paid out bribes in return (“cash for vote”).

Currently there is a price disparity between $SOLID and veSOLID of between 80% – 85% (I.e. 1 Solid around 8 veSOLID on the OTC market) as the TVL increases on the $SOLID network we expect this disparity to converge, ultimate fair value is 1 veSOLID = 0.8 $SOLID. Other benefits, such as boosting the value of your LP will also be available once the platform is fully developed and has the requisite size.

Who are the people behind Solidly? The main founder and backer is Roosh https://twitter.com/KingsFantom and there are a number of savant developers working on the platform. Roosh made his money on FTM (buying under 1c back in the day) and is an early adopter of $LINK, $Muon and the main holder of $SYMM. Why is this important? Because $SYMM is launching in Q1 2024 and announced on the 31st of December 2023 that it will be establishing frontend partnerships focusing on the UI while they focus on the plumbing of their Perp Dex… guess who will be one of them? Solidly for sure. $SYMM has no order book and is running on a request for quote basis, buyer interacts with a seller (broker dealer) who’s limits are those with his bank. This is the way to bring in the virtually unlimited capital market into crypto. Oracles for this service will run on $Muon nodes (which are orders of magnitude faster than $Link Nodes) – but I digress.

Why MOON?

The reason why there was such an outrageous pump are manifold:

- They built something that works and is useful (stopping JIT vamp attacks);

- It will be omni chain (launched on FTM a few weeks ago and became the No 2 Dex within 40 hours of launch) next up is “a large EVM with more volume than $FTM” per Roosh on 3rd of Jan. which was Arbitrum as they have many grants available to attract new protocols. They are also on Based and Optimism with more chains to come imminently;

- Significant Partnerships recently announced (in the past few weeks!) including, but not limited to Kyberswap, Paraswap, Lidofinance, FTM (Gas Monetization Programme), Firebird Finance;

- Tokenomics: 82m of 100m $Solid have been emitted. 95% of these 82m is perpetually locked by voters (as veSOLID). Liquid naked SOLIDs are only 7.5m, which will be the same tokens used on more than 10 chains. The token will have arbitrage opportunities – scarcity!

- Solidsync: TL: DR Solution to bridging issues across chains. More details here: https://x.com/SolidlyLabs/status/1738609337738662269?s=20;

- Chain Link CCIP: Solidly are part of the early adopters cohort of the Chain Link CCIP (their cross chain platform). This is a very prestigious honour and not the normal Chainlink tie up. It brought the eyes of the Linkmarines ($LINK fans) and their wallets to $SOLID when it was announced a few weeks ago https://x.com/SolidlyLabs/status/1736058461241143573?s=20.

More Moon?

Well there has been a considerable pullback of almost 75% from the ATH. This is why to TAKE PROFITs even on your conviction trades. The reasons for the 4 USD pump remain valid and the token is now across 5 chains instead of 1 with more partnerships announced and an audit to be released imminently with no major or even minor findings. Each new chain added will have grants for bringing solutions to it and there will be quite a bit of crossover. There is still enormous scope for this platform to grow, the team are visionaries and have put in the hard work through the bear market and emerged stronger for it on the other side. Everyone loves a good redemption arc and it has been a SOLID start to the year so far! FTM is ramping up so if you are looking for other projects (some of which are no more than memecoins) to have a look at – look here https://fxtwitter.com/KingsFantom/status/1737788525959917572