Happy $BTC ATH! This was immediately followed by a bad dump (welcome to crypto Wall Street) and an almost immediate buy back over the following few hours. Depending on where you look (and we are looking at IntentX), $BTC went from $69,397 to $59,057 over the space of three and a half hours – that’s a $10,340 drop in a very short period of time or roughly a 15% drop. For the No 2 token by MCAP, $ETH its price went from $3,828 to $3,206 over the same period, a drop of $662 or 17%. This is yet another example of when $BTC dumps, everything dumps harder.

What was pretty interesting was that just after the ATH was breached, a wallet that mined $BTC almost for free back in 2010 was selling in 50 $BTC clips… tip of the hat to you ser whoever you are! https://twitter.com/BitcoinNewsCom/status/1765085501684322472 It was not enough to tank the market, but the seller was sure they were not going to miss another top!

What does a listing on a CEX mean?

Last week’s article was pretty heavy on the technical side, so this week we will once again push back our planned agenda and talk about market cycles in crypto land. What has happened in the past and what may happen going forward. Of course, like traditional markets, no one can know for sure what will happen. They can make educated guesses and take their chances. Technical analysis does work occasionally for the more developed crypto currencies like $BTC, $ETH, $LINK etc. For newly launched tokens or …. (gasp) Memecoins… you are taking a very big risk in acquiring them.

A point to note is that a listing on a CEX, especially one of the big ones like Binance or Kucoin, does not mean that the exchange has done any due diligence on the underlying project or the team behind it. Listings are a pretty opaque business. Listings generally occur through a combination of marketing / lobbying from the project and it’s community or, more often, the project paid for the listing. There is no team of investment banks behind a token listing as you would expect for a listing on the New York Stock Exchange who underwrite the issuance (and dump on their clients of course!). A common mistake for new entrants into the crypto market is that an exchange listing bestows some kind of legitimacy onto a product. It does not. It does bring more liquidity though which usually pumps the price considerably. This is why a lot of projects in the pre-sale space will say they will get listed on Binance, apart from being a fraud if this has not already been agreed in writing with Binance itself – which some crypto bros are unaware of – this kind of shenanigans will get your dear project (and the team behind it CZ?) permanently blacklisted by Binance https://www.bsc.news/post/cz-do-this-and-earn-an-automatic-blacklist-from-binance. Good. With respect to Memecoins – arguably the riskiest asset you can gamble on in crypto (can you really “invest” in nothing but speculation?) Binance and other exchanges will also list them too. Binance did have the courtesy to publish a “buyer beware” notice with respect to $Shiba (a memecoin) but that follows for all tokens listed on CEXs https://www.quora.com/What-is-your-opinion-on-Binance-Lists-SHIB-as-CZ-says-it-is-Super-High-Risk

Scam coins on Token Generation Event

Another matter for readers to be aware of is that on a Token Generation Event (“TGE”) for a token, a number of scam tokens will launch around the same time to try and trick investors into buying them “early” as opposed to buying the proper protocol token. Always, always, always check the socials of the relevant project and do not click any links in the comments posted below. Your token could be launched on Ethereum and someone is trying to get you to buy the same token on Solana for instance, this is probably a scam. We always get a chuckle from the various scammers posting in certain Key Opinion Leader’s (“KOLs”) accounts posting about free airdrop this free airdrop that. It bears repeating as on launch, if you were in a presale, the price can really rocket (usually via bot buying) before falling back, so if you have received a portion of your tokens and sell them you may sometimes recoup your principal and have the rest of your tokens as a free bet whenever they are distributed to you.

Cycles

As $BTC is the first and largest by MCAP crypto out there. It sets the cycles in crypto currency. L’Etat c’est Moi! $BTC has a market cycle built into it. There is a technical event that occurs roughly every four years. As part of $BTC’s code, after every 210,000 blocks are added to the chain, the mining reward (for solving the transactions and adding the block to the chain) is cut in half. This was done by the creator(s) of $BTC to slow down the pace at which supply of $BTC can be added for circulation in the market. There can only ever be 21,000,000 $BTC. There are around 19.65 MIO $BTC in circulation now. So there are only 1.35 left to mine over the next century – the last $BTC is expected to be mined at some point in 2140. At that point, miners will be rewarded in transaction fees. Infact, read all about it here https://bitcoin.org/bitcoin.pdf – we are always amazed a how many people in the crypto industry have not read this document. It is like being a priest and having never read the bible! If the whitepaper is a little dense for you, have a look here for a nice simplified version of it https://www.bitpanda.com/academy/en/lessons/the-bitcoin-whitepaper-simply-explained/

Halving smalving

Who cares about the halving? We now have ETFs in the market!? Well, most financial institutions want to get their hands on the newly mined $BTC as there is no transaction history behind it. Unlike cash which is pretty much untraceable, you can follow the progress of $BTC (or parts thereof) through the blockchain from the time it was mined until the time it appears in your wallet. Given the often conflicting positions of various US based agencies on crypto in general, the financial institutions would prefer not to have the headache of verifying that the $BTC comprising their ETF were never involved in any nefarious activities. So, they will pay a premium for that. Money has no sin but crypto does??

Assuming 210,000 blocks for 4 years. There are 52,500 blocks per year at the current reward rates of 6.25 BTC per block (assuming a price of $69,000 per BTC) = $22,640,625,00 per year at the current rate and value of BTC. This will be cut in half on the 20th of April (the expected halving date). The $BTC EFT inflows on the 3rd of March alone was $562,000,000 – over 10 times the mined supply https://cointelegraph.com/news/bitcoin-etf-inflows-hit-562-million. This is BEFORE other financial giants such as Bank of America’s Merril Lynch and Wells Fargo (amongst others) start to offer $BTC ETFs to their clients who are clamouring for them. See https://www.reuters.com/technology/bofas-merrill-offering-spot-bitcoin-etfs-clients-source-says-2024-02-29 for more details. It was long suspected that a large number of financial institutions were accumulating $BTC over the past years to satisfy the perceived demand for these products… it looks like they will be short and will need to market buy. Bringing further buy pressure to $BTC. Never mind that based on today’s figures, in a few months, the inflows to $BTC ETFs will be x20 the amount of the mined supply.

But this time it is different

Never before has there been such a large buying pressure on $BTC. In the last bull run we had large CEXs playing around with the price of a large number of crypto currencies and retail investors FOMO’g in trying to make their fortune. This time around we already have $BTC buying pressure and we will, hopefully, have $ETH buying pressure as the applications for $ETH ETFs come to their logical conclusion. History does not repeat, but it rhymes.

Rotations

The tactic of Holding On For Dear Life (HODLing) does not work. While Cardano has an enormous runway of funds and will eventually be a behemoth, have a look at this chart:

If you bought at $0.01 and blindly held on until $3 was hit, you then saw the value of your fortune turn to ash. While the Dapps building on $ADA had some explosive gains in the last bull market, $ADA did not shoot the lights out relative to it’s prior ATH of $1.08. This is an illustration of the main point of the article. Do not marry your investments, sell them opportunistically. You are in this risky asset to make not money. Some are “in it for the tech” but that is a vanishingly small minority of investors.

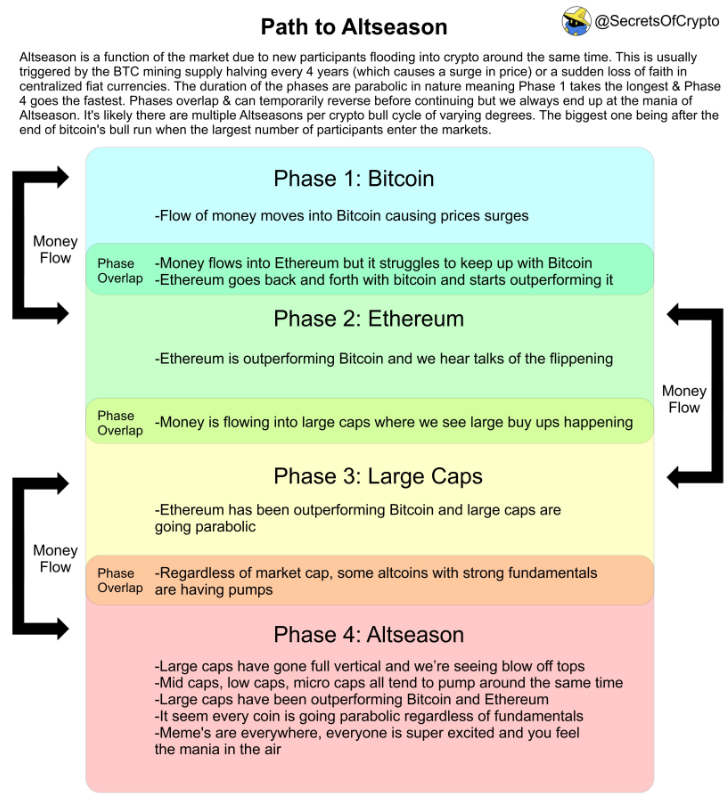

What tends to happen in crypto is $BTC pumps, main Alt coins (biggest by MCAP) such as $ETH, $SOL (which briefly flipped $BNB for 4th this week) $DOT, $LINK, $MATIC etc. pump. After this, the hot topic coins pump considerably (currently AI, Meme and Gaming – last cycle it was anything Metaverse (whatever that means)) and then everything else pumps. In the last bull run, once $BTC had hit it’s previous ATH and started retracing the Alts went on a mindbending run for about a month. This pump was where fortunes were made, and then lost as investors after having booked gains continued to “buy the dip” that just kept dipping.

There are violent retraces in crypto, we have just seen a small one this week. Sometimes the drops are between 20 and 30%. These can be buying opportunities for tokens that have rallied considerably and were overpriced. Selling opportunities abound. But in order to realise gains, you must infact sell and not keep moving the bar higher. Have a plan and STICK TO THE PLAN!

Show me the money!

What most investors do is they go into the larger MCAP tokens first. Make a bit of money there, especially $BTC and $ETH. Then they cycle some of their profits down to the lower MCAP tokens (but still in the top 30). Then they diversify and become sector specific like Defi and Crypto Gaming and try to buy small caps there and sell them as they become medium sized caps (they have maybe x5’d or x10’d or even more from the investor’s buying price) and then rotate the profits back into finding other promising small caps in the sector. As you can see from coinmarketcap there are dozens of sectors to get into. What we would say is that you cannot master them all. Do not spread yourself over dozens of tokens as that way you are sure to miss selling signals and lose money on your investments. You simply cannot keep track of it all. If you must invest into Memecoins, do it with your “play” money. Expect it to go to zero.

Prospecting

Finding gem projects at the start of a bull cycle is easy, pick the ones that survived the bear. Buy them and hold and sell at a certain multiple. You can see from their charts that they had larger MCAPs before (and probably some silly Fully Diluted MCaps) but they have survived a vicious two year bear cycle and are leaner and meaner because of it. For example $SUPER was extremely undervalued at $0.09 last year (it is now $1.40). They may even have a working project / ecosystem now that generates revenue. As we get further into the bull market it becomes exponentially more difficult to spot gems. There will be so much market noise. You will be pulled many different directions by advisors and friends sending you a “sure thing” and adding Do Your Own Research (“DYOR”). You may over trade, sometimes doing less is more. If you already have your bags packed, keep it simple and sell them over time.

Below is the Path to Altseason created by https://twitter.com/SecretsOfCrypto

There is usually some rotation in portfolios as mid caps become large caps, you sell the large caps and buy new micro and midcaps. There could be as many as three such cycles. The trick is not to be left holding big bags of various altcoins when the music stops. And it will stop!

Survival

There will be winners and losers in this next cycle. The winners will mainly be those who are disciplined, rational in their investment decisions, maybe get a bit lucky and, crucially, sell their tokens often and especially when they do not want to. The losers will be those that think they are geniuses, cocky, market buy whatever they want whenever they feel like it and refuse to realise any gains. Worse still, they may realise gains and then plow them straight back into risky projects. When we speak about realizing gains we mean taking assets off chain or sticking them in $BTC or $ETH the least riskiest of the crypto assets apart from stablecoins such as $USDT / $USDC.

Remember, the trend is up and to the right at the moment. The trend is your friend…. Until the end of the trend! Be smart and above all else, don’t be greedy.